Half of the year may be over, but it’s not too late to start building wealth in 2024. Most people are looking to start getting their finances in order but don’t know where to begin.

Everyone has different financial goals but there are some common habits and financial skills everyone should master to help them accomplish their goals. In this guild you will learn step by step how to build your wealth and some habits you can start mastering today.

1) Get a Baseline of Where You Currently Are

The first step I always recommend to clients when they ask me how to start building wealth is to know your current financial situation.

I am a strong believer of the old saying “in order to know where you are going, you must know where you have been”.

The main reason I recommend this is because after getting your financial data on paper, you can see what mistakes have been made in the past and track your current progress.

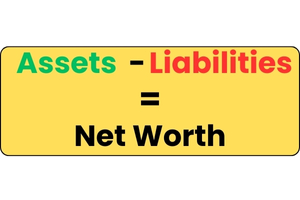

Find your net worth

First, I recommend tracking your Net Worth. Net Worth is calculated by taking the sum of all your assets and subtracting that by the sum of all your liabilities.

Net Worth Formula

Note: Your Net Worth is a snapshot at a particular time.

Examples Of Assets

Examples of Assets include but are not limited to:

- Cash Account Balances

- Checking Account Balances

- Savings and Money Market Account Balances

- CD Balances

- Investment Account Balances

- Brokerage Accounts

- Annuities

- Retirement Account Balances

- 401k/403b

- IRA/Roth IRA

- Physical Property

- Homes

- Cars and other Vehicles

- Jewelry, Artwork, Physical Gold and Silver

Examples Of Liabilities

Examples of Common Liabilities include but are not limited to:

- Credit Card Balances

- Personal Loans

- Student Loans

- Mortgages/ Home Equity Loans

- Balances Due for Utility Companies

Expert Tip: I recommend calculating your Net Worth on a Monthly Basis with the balances being from the last day of each calendar month. You can do this in a Excel Spreadsheet or with a pen and paper.

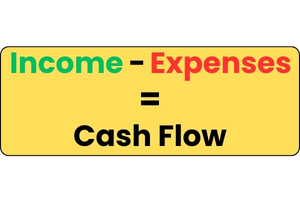

Add Up Total Income and Expenses

Income and Expenses are the Cash Flow portion of your financial picture.

Due to the technology of debit and credit cards, it is easy for our spending to get out of hand because paying for goods and services is as easy as swiping a piece of plastic.

I highly recommend to start your goal of building wealth to take a total of your income and expense and figuring out where your money is coming from and where it is going and to put that information on paper(or excel spreadsheet).

To do this I recommend for the previous month you pull up your bank statements, credit card statements and any other account statements you spend money from and on a separate sheet of paper writing down each expense and adding them up.

This can be as simple as a 2 column chart with one side labeled Income and the other labeled Expenses. If you want to go into more detail, you can categorize each Income and expenses transaction.

Examples of some common Income categories are:

- Wages

- Commission Earned

- Interest Income

- Dividend Income

- Business Income

- Rental Property Income

Examples of some common Expense categories are:

- Food

- Restaurants

- Groceries

- Transportation

- Gas

- Car Insurance

- Car Maintenance

- Public Transportation

- Utilities

- Mortgage

- Electric

- Gas

- Water

- Cable and Internet

- Cell Phone

- Garbage

- Entertainment

- Clothing

- Subscriptions

- Healthcare

- Deductibles

- Gym Membership

- Medicines and Supplements

- Pet Expenses

- Pet Food

- Pet Toys

- Pet Insurance

- Vet Bills

Banker Tip: Do not add transactions like bank transfers, credit card payments and loan payments (besides your mortgage).

- For Cashflow purposes I recommend adding your full mortgage payment.

- For total expense, I recommend you add your Mortgage Interest and any payments from your escrow account. You do not add your principal payment due to that money going to pay off a liability.

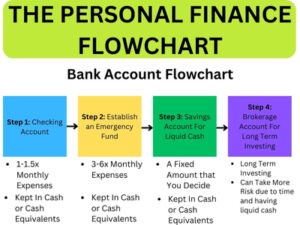

2) Get a Handle on Basic Banking Skills

When I say get a handle on your basic banking skills, I mean to see if your bank is meeting your needs and see if you are using all their services available.

A few things to look for when doing this include the following:

Know Your Monthly Service Fees

The next step to getting a handle on your finances is to see if your current bank is meeting your needs and see if you are getting charged a monthly service fee.

In today’s world, there is no need to pay a monthly service fee for a basic bank account. Bank account fees can range from $5.00 to $35.00 per month depending on your bank and which account type you have. To put those numbers in perspective, the monthly service fees can range from $60 to $420 per year.

If you notice monthly service fees, talk to your banker to see if there are ways to avoid them or if there is a more appropriate account type.

If there are no ways to avoid the service fee, consider switching your banks to a bank that does not charge one.

Establish a Relationship at Your Local Bank

In today’s world with technology capabilities always improving, most people are able to bank 100% online. Banking online is a great tool and I am not discouraging people from doing so but having a banker you can trust at your local bank is important.

Your local banker is trained in finance and ways to help you achieve any financial goals you may have. Building this relationship gives you a professional perspective and maybe some clarity on any issues or questions you may have.

Make Sure You Are Using All The Online Convenience Tools Your Bank Offers

You can pretty much do all of your banking with online tools such as Bill Pay, Zelle, Transfers, Wire Transfers and even account servicing like ordering Debit Cards.

Understanding what features your Bank app has to offer can make your life easier when doing everyday transactions.

Talk to your local banker and see if your bank offers any of these services.

3) Start Tracking Spending and Budgeting

This step may be one of the most important ones on this list. Tracking your Spending and Building a Budget is one of the fastest ways to increase your wealth.

For example, If you are spending more than you earn each month, your net worth is only going to go down because you are going to have to use credit to make up the difference. This example is called a Negative Cash Flow Problem.

When your cash flow is negative you are forced to use credit cards and pay interest at an extremely high rate which then exponentially multiplies the problem.

Tracking Spending

How to track spending was listed in Section 1 of this article. The importance of it is after you calculate the previous month, you can look at places you spent more than you would have liked and find ways to make cuts on expenses.

The first place I recommend cutting expenses is to look at your subscriptions like Netflix, Hulu, Disney+, Gym Memberships, and Food Delivery Service Memberships. According to NGPF.com, the average person spends $86 per month on subscriptions alone.

Budgeting

After you have seen your spending habits by tracking your spending, you can then see where you can start making cuts and how much you want to spend per month.

Having and sticking to a budget is important because it helps you not overspend on items you may not need and holds you accountable for the purchases you do make.

Cutting expenses may be difficult and sacrifices may have to be made to stay on budget but if you can stick it out for a year that money you saved can be used to help you in your wealth building journey.

4) Establish an Emergency Fund

What is an Emergency Fund?

An Emergency Fund is a savings account that you use in case an emergency happens. This fund if an unexpected emergency happens, you do not need to go into expensive debt to cover it.

The types of emergency can range from losing a job, an unexpected home repair or an unexpected car repair.

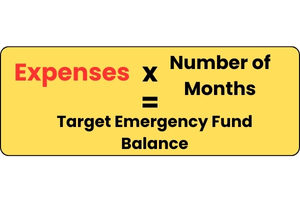

How Much Should I Put In An Emergency Fund?

There is no exact number of how much you should keep in an emergency fund but there are some guidelines you can follow.

The guidelines are to add up your total expenses per month and multiply that by 3 to 6 times. 6 Months of expenses is a conservative number but I recommend all of my clients to have at least this amount of money set aside for emergencies.

Emergency Fund Balance Formula

What Type Of Account Should I Put My Emergency Fund In?

The type of account may vary from person to person but I always recommend something that is high yield. This means it pays you a high amount of interest compared to commercial banks.

Some banks you can use are:

Another option is to open a Brokerage Account and purchase money market funds. Money Market Funds are seen as cash equivalents and are considered liquid. The typical time frame to liquidate money market funds are 1 business day.

You can open up a brokerage account at the following institutions:

Using a money market may require a bit of extra research but the benefit is you may be able to find a better rate.

5) Pay Off High Interest Debt

Paying Off High Interest Debt is Important in building a healthy financial future.

High interest debt is usually in the form of Credit Cards, Personal Loans and Home Equities but I classify it as any rate higher than the risk free interest rate you can safely get. A Risk Free Interest Rate is the rate of a high yield savings, money market, CDs and Treasury Bills.

Right now my recommendation is to pay off any debt over 5.00% but this number can fluctuate based off interest rates.

How to Start Paying Off High Interest Debt?

When people asked me how to start paying off debt, the first thing I recommended is creating a list with 4 columns. These columns should include the Name of the Company Holding The Debt, Type of Debt (credit card, student loan, mortgage, etc.), Interest Rate and Current Balance.

Tip: This information can be found on your statements. Use your most recent statements because some interest rates can be variable.

After you have a list of all your debts, there are 2 methods people use to pay off debt. The Methods are as follows:

Debt Avalanche

- The Debt Avalanche method is when you work on paying off the highest interest debt first. To accomplish this it is recommended to pay minimum payments on all debt then any extra money left over, use to pay the highest interest account on the list. As accounts get paid off, you target the next night rate on that list and so on.

Note: This is my preferred method of debt payment. Overall you pay less in interest over time.

Debt Snowball

- The Debt Snowball Method is the method I call the”feel good method”. When paying debt off with this method, you target the lowest balance account first and disregard the interest rate. The thought behind this is it will give you motivation to continue paying down debt.

6) Start Investing

I cannot stress this enough. Open a brokerage account and start investing. Most people think that you need a lot of money to start investing but in todays world you can open an account with no money.

You can start with as little as $25 a paycheck and most brokerage houses now offer fractional shares. Fraction shares are a way to purchase less than a whole share so everyone can get into investing

Most brokerage accounts do not charge trading fees anymore. This does not mean there are no fees associated with the investment you choose so definitely research anything you are thinking about.

What Do I Invest In?

This is a difficult question to answer due to everyone having different investment objectives and risk tolerance. According to Investopedia.com, Risk Tolerance is defined as “degree of risk that an investor is willing to endure given the volatility in the value of an investment”.

I know this definitely may sound confusing but all it means is, how much risk are you willing to take to get the returns you are looking for. In investing, usually the higher the risk taken, the higher probably for higher return.

Most people give the advice of investing in S&P 500 Index funds because it is very difficult to beat the S&P 500. That is sound advice that I do agree with but make sure you do your research and understand the risk involved.

If you decide to invest in S&P 500 Index Funds, there are a few that I recommend:

- VOO – Vanguard S&P 500 ETF

- SPY – SPDR S&P 500 ETF Trust

6) Save For Retirement

Even though saving for retirement is last on this list, that does not mean it isn’t important. Saving for retirement is extremely important and should not be overlooked.

According to a recent AARP study, 1 in 5 Americans over 50 do not have any retirement savings.

Most employers offer a 401k, 403b or some other type of retirement plan. Even if they do not offer a plan it is then recommended to invest in an IRA.

Each one of these accounts have their own benefits but for a 401k or 403b most employers have a match. This means that for every dollar you put in, they will match a certain percent. If you do not contribute at least the match, you are leaving money on the table.

Tax Benefits of Retirement Accounts

Tax Benefits of Traditional 401k/403b and IRA

There are also many tax benefits you can take advantage of. The first is if you contribute to a traditional version of a 401k, 403b or an IRA, some of that money can be tax deferred. This means you don’t pay taxes on that money now and pay taxes on it when you retire.

According to IRS.gov, The contribution amount for these accounts are as follows:

- Traditional 401k/ 403b – $23,000

- Traditional IRA – $7,000

Tax Benefits of Roth 401k/403b and IRA

The tax benefits of a Roth account is that you pay the taxes up front on the money and the money grows tax free.

The Contribution Limits for Roth Accounts are the same as Traditional Accounts.

How Do I Pick A Roth or Traditional Account?

The idea of a traditional retirement account is that you are a higher income earner and you believe your tax bracket will be lower when you retire. This would cause you to pay less taxes in the funds

A Roth Retirement account is for people who are in a lower tax bracket now and believe their income will grow in the future to a higher tax bracket.

There are other considerations to keep in mind when choosing the type of retirement account so consulting with your tax professional is advised.

Conclusion

It’s never too late to start working on your financial situation. With these 7 steps, you have a guideline to start building wealth for you and your family. Keep in mind I do recommend doing these steps in order to have the greatest success. To learn more ways to increase your worth, Subscribe to our newsletter.