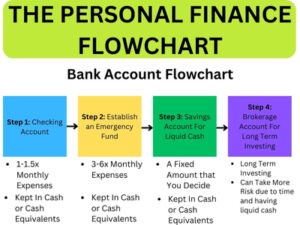

Step By Step Personal Finance Flowcharts: Bank Accounts To Have

The most common question I get, especially from people who are visual learners like myself, is “How Can I Visualize The Wealth Building Process Because I Don’t Always Understand What The Books I Have Read?”. To better help my clients with this issue, I have come up with a Personal Finance Flowchart System to help visual learners understand the steps to Build Wealth.

This will be a series of articles so stay tuned for more!

Step 1 - Checking Accounts

This one comes as no surprise but the Checking Account is the Swiss Army Knife of bank accounts. This account isn’t going to make you rich with interest, but it helps you process everyday transactions.

The Checking Account is Designed To Help you receive your paycheck and pay your everyday expenses. The checking account will also be the account that you transfer money to your other accounts from.

How many Checking Accounts Should I Have?

My recommendation on this is between 1-2 Checking Accounts. I personally have 2 checking accounts, 1 for receiving my direct deposit and another for paying my bills out of.

The reason I recommend this is because when you pay your bills automatically, you are giving that company either your routing number and account number or debit card number. If you were to ever have fraudulent activity and the account number has to change, you now have to change your direct deposit information with your employer. This can potentially lead to a disruption in pay.

What Balances should I keep in my checking accounts?

My general recommendation is In your primary checking account, 1.5x your total expenses minimum or the minimum required to avoid a monthly service fee.

The 1.5x is so that you can pay all of your bills without having to worry about a check bouncing.

If you go the 2 checking account method, I would recommend a set amount in your Primary account and the smallest amount without getting a service fee. The goal of this method is to keep minimal money in your checking so the rest can grow in other instruments.

For Example:

Note: In this example, Bank minimum to avoid Service Fee is $500

- Direct Deposit Account: $500

- Bill Account- $500

The goal is when you get your direct deposit, transfer the amount needed to your bill account and the bills will be paid from there. Any money left over money above this minimum would go to other accounts such as a savings or brokerage.

Step 2 - Building an Emergency Fund

The next objective on the financial health flowchart is to Establish an Emergency Fund aka a Sinking Fund.

The definition of an Emergency Fund is “ an account in which you put money away in case of an emergency or unexpected expense arises”.

The idea behind an emergency fund is having money set aside so if an unexpected expense comes up, you do not have to go into debt to pay for it.

An example of an unexpected expense can vary from you car breaking down, hot water tank going, service needed to fix a home, losing a job, etc.

The way I recommend this is to establish a separate interest bearing account. This account can be either a High Yield Savings or even a brokerage account to purchase money market funds.

The typical recommendation is 3 to 6 months of expenses. This gives a nice buffer and helps you avoid high interest debt such as credit cards or personal loans.

How Does an Emergency Fund Work into my Wealth Building Flow Chart?

After your set minimum for your checking account (or both checking accounts if you decide to use more than one) any extra money above that minimum you will use to fund that emergency fund.

I highly recommend writing down that number so you have a visual of that goal.

Emergency Fund FAQ

It is recommended 3-6 Months of expenses, 3 months being considered more risky and 6 months being more conservative.

Having too much money in an Emergency fund puts you at risk for missing out on potential interest you could be earning on other vehicles.

This is personal preference but I believe liquidity is your main concern. It can be a savings account or a brokerage account where you purchase money market funds.

Note: I personally use a brokerage account for my emergency fund. Brokerage accounts can take a few days for you to actually receive the funds if they are needed.

For me, I have high credit card limits so if an emergency comes up I charge the amount and use this account to pay off that amount in my credit card.

An Emergency Fund should be a top priority to avoid having to go into debt for when emergencies happen. The average credit card debt is about $6,500 per person according to a recent CNBC article.

Credit Card Debt is always a high interest rate so if you can avoid falling into this trap, it will help you in the future.

Step 3 - Establish a Liquid Savings Account

This step is optional but this is something that I like to do. I establish a liquid savings account that I use for any planned home renovation, vacations, and other non necessities.

Just like the emergency fund, I use a separate brokerage account and invest the funds in Money Market Mutual Funds or Short Term United States Treasuries (TBills).

The amount you want to keep in this is based on personal preference. My Number is about 15% to 20% of my net worth. I invest in real estate on the side and like to have a little extra cash if a deal were to come up.

Step 4 - Establish a Brokerage Account

Now that you have an account to manage transactions and create liquidity through an Emergency Fund and Cash Savings Account, it is time to establish a brokerage account.

This brokerage account you establish is set to be for your long term investing strategy. This will be the account you will buy stocks, bonds and mutual funds through based on your risk tolerance and investment knowledge.

If you are not familiar with Warren Buffett, he is a big believer in investing in the S&P 500 Index. Most investors agree with him and believe that you can be the best investor and have all of the knowledge in the world but you will not beat the returns of the S&P 500.

Knowing this, a basic recommendation is buying S&P 500 Index Funds. S&P 500 Index Funds have low expenses due to them being passively managed and you can expect the full return of the total stock market.

A Few S&P 500 Index Funds are as follows:

Note: Before investing, it is always recommended to do research on what you are buying and understand the risk associated with that particular product.

Conclusion

This first step in building wealth is understanding what types of accounts you would have, how to use them and in what order to establish them. Flow Charts are a great tool to organize your personal finances.

Sometimes understanding this process is difficult, so getting a visual of it through flowcharts can help. Doing this process in the order it is shown helps you make decisions based on priority.

This method may not work for everyone and you can always adjust as needed. This is the method I personally use and have had great success. I love to hear any suggestions and opinions you may have. Feel free to comment below